Climate Change Initiatives

In recent years, climate change, has had a significant impact on the environment and the world.

MJC Group considers this fact to be a material matter and, following the Task Force on Climate-related Financial Disclosures (TCFD) framework, analyses the key risks and opportunities related to climate change within the Group and discloses the results of its analysis of its impacts.

In addition, the Group is committed to saving energy and reducing CO₂ emissions to mitigate climate change.

Governance

The Group believes that sustainability is an important corporate activity, and therefore has established the governance structure to achieve medium to long-term improvements in corporate value.

For more information, see Sustainability Initiatives, Sustainability Promotion Structure.

Risk management

At MJC, our president is a chief executive of risk management to mitigate and reduce substantial risks to the business, ensuring continuous operation. A Compliance Risk Management Committee has been set up to monitor activities throughout the Group, ensuring that each department’s risk management activities remain appropriate to any risks that may occur.

The committee reports their findings to the Management Board, then the Board of Directors deliberates them.

Strategy

The risks and opportunities of climate change were identified according to the impact of climate change on business, based on the latest Sixth Assessment Report issued by the Intergovernmental Panel on Climate Change (IPCC), and the two scenarios issued by the International Energy Agency (IEA): 'Global average temperature increase by 4℃ or more' and 'Global average temperature increase well below 2℃ as agreed under the Paris Agreement (ideally below 1.5℃).'

Transition risks arising under a scenario of well below 2℃ were considered for the 2030 projection, and the physical risks arising under a scenario of 4℃ or more were considered for the 2050 projection.

For opportunities, we considered elements that are important for the Group to achieve its strategy and strengthen its business foundation under both scenarios.

Going forward, we will further examine the impacts on our business operations and disclose this information in due course, while still aiming to contribute to society through our business activities.

| Category | Climate change risks and opportunities identified | ||

|---|---|---|---|

| Transition Risks | Policy / Legal Risks |

1 | Increased energy costs due to the introduction of a carbon tax |

| 2 | Increased costs due to higher electricity prices | ||

| Market | 3 | Increases in raw material prices associated with decarbonization | |

| Technology | 4 | Loss of sales opportunities due to delays in the development of energy-saving technologies | |

| Reputation | 5 | Decrease in sales due to increasing demands from the stakeholders for more environmentally friendly practices every year and the inability to respond to such demands | |

| Physical Risks | Acute Risks | 6 | Shutdowns and recovery costs incurred due to disaster damages to the Company |

| 7 | Decrease in sales due to supply chain disruptions, shutdowns or delays in shipments caused by extreme weather events | ||

| Opportunities | Technology | 1 | Improved competitiveness via energy-saving product releases |

| 2 | Improving the competitiveness of our products by manufacturing products using clean energy | ||

| Reputation | 3 | Increased demand for our products due to the expansion of the semiconductor market, including infrastructure development and digitalisation to curb climate change | |

| 4 | Improved competitive advantage in dealing with business continuity in the event of a disaster by building BCP measures | ||

Indicators and targets

As part of its contribution to a decarbonised society, the Group plans to reduce its Greenhouse Gas (GHG)*2 emissions in Japan in gradual steps from 2024 onwards. Furthermore, the Group will continue to monitor its GHG emissions under Scope 1*3 and Scope 2*4 and disclose appropriate information.

Changes in the Group's GHG emissions (Scope 1, 2)

| GHG emissions(t-CO₂) | 2020 Actual | 2021 Actual | 2022 Actual |

|---|---|---|---|

| Scope1 | 2,266 | 2,642 | 2,814 |

| Scope2 | 10,505 | 10,929 | 11,168 |

| Total | 12,771 | 13,571 | 13,982 |

- *1 Figures are on a consolidated basis, including domestic and international.

- *2 GHG: Greenhouse Gas

- *3 Direct emissions: Emissions from the operator's own fuel combustion and industrial processes

- *4 Indirect emissions: Emissions associated with the use of energy such as electricity, heat, and steam supplied by other companies

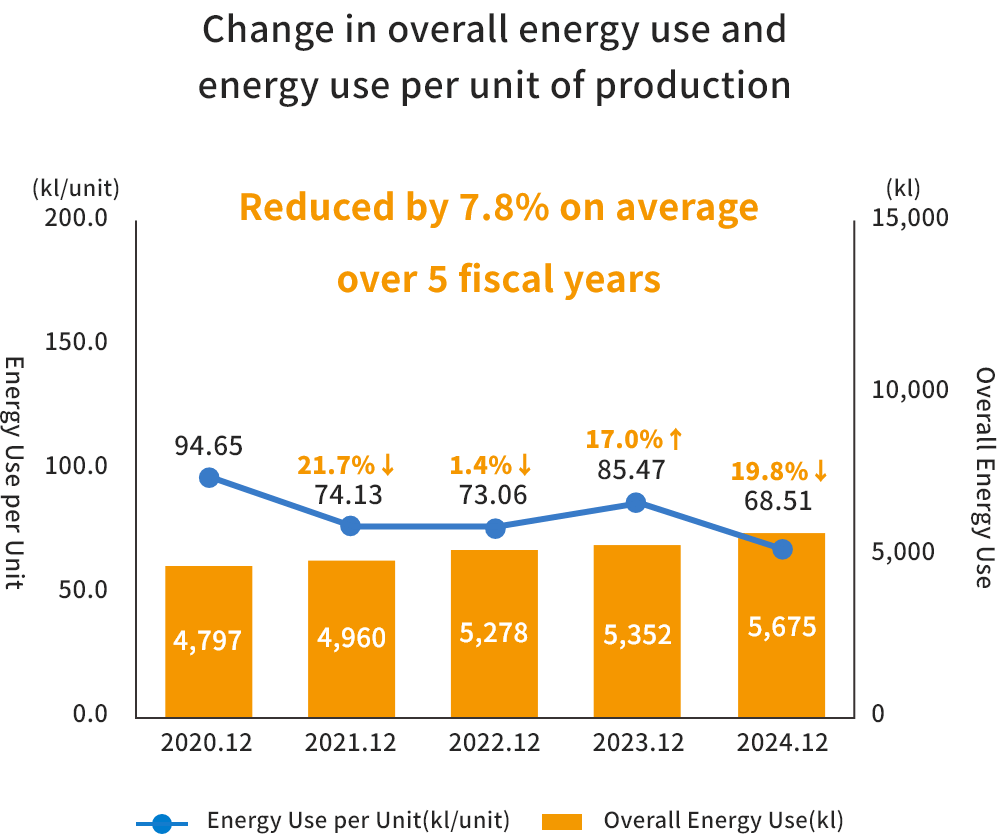

All domestic establishments are obliged under the Energy Saving Act to monitor their energy consumption and are required to reduce their energy consumption intensity*1 by more than 1% on a five-year average basis for the entire business over a medium to long term.

Over the five-year period from 2018 to 2022, we achieved an average reduction of 9.9% in energy consumption at our domestic sites, far exceeding the minimum target reduction of 1%. Energy consumption has increased in line with increased production and the introduction of new equipment.

MJC will continue to promote reductions in energy consumption intensity and further promote energy saving to mitigate the effects of global warming.

- *1 Energy consumption intensity: a value representing energy efficiency. The smaller the value, the higher the production efficiency and energy saved, therefore contributing to the mitigation of global warming. (Unit energy consumption for domestic sites is calculated based on energy consumption and production numbers.)